“Without good liquidity planning, you’re constantly putting out fires. Good liquidity planning is like fire prevention.”

Liquidity planning is indispensable for companies. In the first few years of my self-employment, I kind of did it by instinct. With a handful of customers and projects, that’s no problem. If necessary, you leave a little more money in the account so that you don’t fall short.

Then things got more complicated: more clients, more employees & freelancers, many projects. I quickly had to manage many transactions and volatility increased as well: Progress payments from my clients, salaries / payments to freelancers and suppliers, recurring payments for graphic tools, project management etc pp..

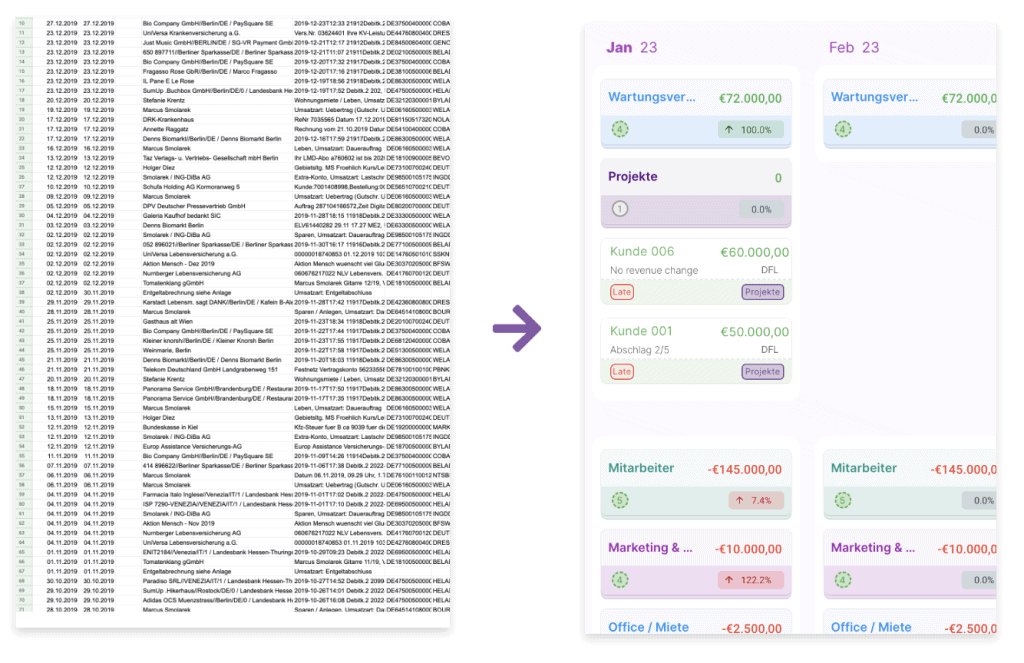

With project-driven business models, you often have to make advance payments. You have to map this very precisely with your liquidity forecast. I have built an Excel table for this purpose. One sheet for each year. At the top, the months from left to right, below that the income, below that the expenses, and at the bottom the total.

The reconciliation to keep the table up to date became more and more time-consuming.

I wanted to map different statuses (Open, Invoiced, …) and scenarios (Probable, Speculation, …) and integrated color coding with Excel scripts. The system grew and grew, and became more and more complicated. The scripts had to be maintained. The more transactions had to be mapped, the slower the table became.

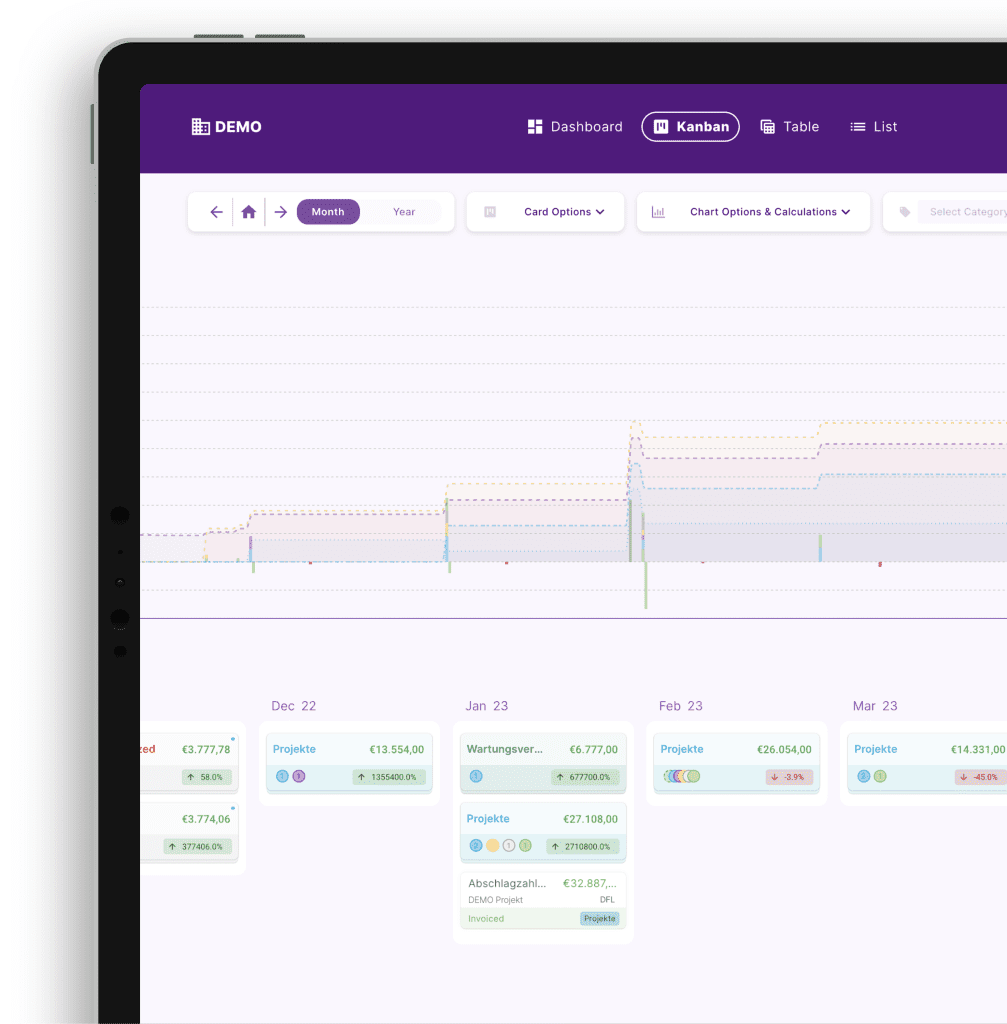

But there was no solution on the market that combined the advantages of my excel spreadsheet (focus on the important transactions, all scenarios at a glance e.g.) with the advantages of a SaaS application (daily update via bank API e.g.).

So we developed a prototype. The rest is history. Excel is a great tool, but for my liquidity planning I now only take finban 🤓

Tools should adapt to the user, not the other way around.

I believe that the best digital solutions are created at the intersection of business strategy, available technology and the actual needs of users.

Things can get very complex very quickly, and a pragmatic, synthetic and clear vision is essential to create something that will eventually be used. Emotions also play a big role, and developing a clear and beautiful aesthetic is paramount to creating a pleasant environment that the user will enjoy spending time in. After all, we all have a preference for beautiful things that simply work.

With finban, 20 years of agency experience cumulates into a product that we need & use for our daily agency life, and into which we have put all our knowledge and love.

Maybe finban can help you with your liquidity planning?